Optometry Billing and Coding Cheat Sheet for Hospital (2026)

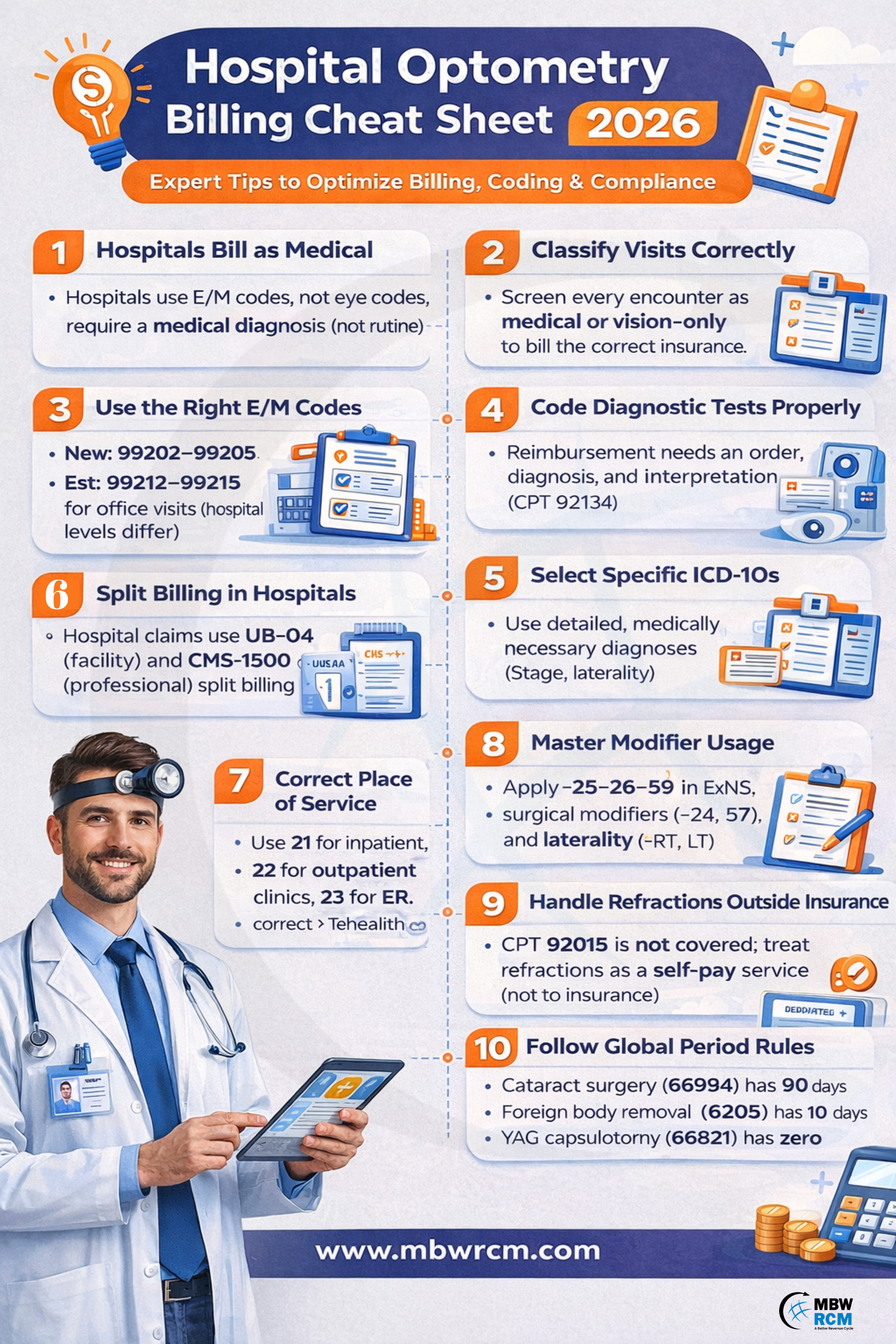

Optometry services in hospitals follow medical billing rules that differ from private practices. In 2026, CMS guidelines and payer requirements demand accurate coding and proper documentation for successful reimbursement. This Optometry Billing and Coding Cheat sheet explains how hospital optometry claims are reviewed, processed, and reimbursed under medical billing standards.

From E/M code selection and ICD-10 usage to diagnostic test billing, modifiers, global periods, and denial trends, this guide offers a clear framework to improve claim acceptance and support smooth optometry revenue cycle management in hospital settings.

Table of Contents

1. First Rule in Hospital Optometry (2026)

Hospitals bill optometry as a medical specialty, not vision care.

Every claim is evaluated by CMS and commercial payers using medical necessity, facility billing rules, and audit-proof documentation. In 2026, most hospital claims are also validated through NCCI (National Correct Coding Initiative) edits, LCD (Local Coverage Determinations), and NCD (National Coverage Determinations).

From a practical standpoint, this means optometry medical billing must follow the same compliance logic as cardiology or orthopedics. Documentation must clearly support a medical diagnosis, clinical complexity, and a treatment plan.

If the encounter is vision-only or refractive, the service is considered non-covered and should not be billed to insurance.

2. Medical vs Non-Medical Optometry Billing

The first operational step in hospital eye care billing is visit classification. This determines whether the visit is billed to medical insurance or a vision plan, directly affecting payer selection, medical necessity validation, and claim approval rates.

Medical optometry includes:

Diabetic eye disease (E11.3X)

Glaucoma evaluations (H40.11X, H40.0X)

Macular degeneration (H35.3)

Keratitis (H16.X)

Conjunctivitis (H10.X)

Ocular trauma

Post-surgical monitoring

Non-medical optometry includes:

Refractive error (H52.X)

Routine vision exams (Z01.00)

Contact lens fittings (Z46.0)

Spectacle prescriptions

These diagnoses fail medical necessity screening under Medicare and most commercial payer rules. In 2026, diagnosis specificity (laterality, severity, stage) is mandatory for claims to pass automated clinical edits, which directly impacts optometry revenue cycle management.

3. Primary Code Set for Hospitals

In optometry billing, coding is driven by medical complexity rather than routine vision services, making standardized medical code sets essential for compliant reimbursement.

A. E/M Codes

Hospitals must use Evaluation & Management (E/M) codes as the primary coding framework for optometry encounters. This is one of the most critical principles of any modern Optometry Billing and Coding Cheat sheet.

Outpatient hospital visits use 99202–99205 for new patients and 99212–99215 for established patients. Inpatient consults use 99221–99223, while inpatient follow-ups use 99231–99233. Emergency department optometry encounters, when medically appropriate, fall under 99281–99285.

E/M levels are selected based on:

Medical Decision Making (MDM) complexity

Or total provider time, including documentation

In 2026, moderate and high MDM encounters (such as diabetic retinopathy or glaucoma management) typically justify 99214 or 99215, provided documentation shows multiple chronic conditions, prescription management, and diagnostic data review (OCT, visual field, imaging).

These E/M codes generate higher reimbursement than eye codes and align with RVU-based payment models used by hospitals.

B. Eye Codes (Restricted Use)

Eye codes (92002, 92004, 92012, 92014) are permitted only when the visit is:

Eye-specific

Not systemically driven

Lacking complex medical decision making

Hospitals using eye codes excessively are flagged because these codes do not reflect hospital-level medical complexity. Eye codes cannot be routinely combined with advanced imaging without a separately documented E/M service.

This is one of the most misunderstood areas in optometry CPT codes selection for hospital environments.

4. High-Risk Diagnostic Test Codes

Hospital optometry relies heavily on advanced diagnostics such as OCT, fundus photography, visual fields, and angiography. These tests are used to support diagnosis, monitoring, and treatment decisions.

Commonly audited CPT codes include:

92133 – OCT optic nerve

92134 – OCT retina

92250 – fundus photography

92083 – visual field threshold

76514 – corneal pachymetry

92235 / 92240 – fluorescein and ICG angiography

In 2026, reimbursement requires:

A physician order in the EHR

A medically relevant diagnosis

A formal interpretation and report

A documented clinical decision influenced by the result

Without interpretation, the test is treated as technical-only and non-payable, which is one of the biggest contributors to Ophthalmology Billing Challenges in hospitals.

5. ICD-10 Codes That Work in Hospitals

Hospital optometry must use medically defensible optometry ICD-10 codes. These codes must clearly justify medical necessity, support the clinical findings documented in the EHR, and align with payer coverage policies to avoid automated claim rejections and post-payment audits.

High-performing diagnosis codes include:

H40.11X – primary open-angle glaucoma

H40.0X – glaucoma suspect

E11.3X – diabetic retinopathy

H35.3 – macular degeneration

H25.X – cataract

H04.12X – chronic dry eye

H16.X – keratitis

H10.X – conjunctivitis

Denial-prone codes include:

Z01.00 – routine exam

H52.X – refractive error

Z46.0 – contact lens fitting

These fail medical necessity rules under CMS and most payer LCD policies. Correct diagnosis selection is the foundation of any effective Optometry Billing and Coding Cheat sheet. Proper ICD-10 coding is important when documenting ocular trauma to support compliant billing and claim approval. Explore ocular trauma ICD-10 coding dos and don’ts.

6. Hospital Optometry Claim Structure

Hospital optometry requires split billing, which is a core difference from private practices.

The facility submits a UB-04 (837I) claim for technical components such as imaging equipment, nursing support, supplies, and facility overhead. The provider submits a CMS-1500 (837P) claim for professional services such as E/M, interpretations, and medical decision making.

This structure is essential for compliant hospital optometry billing and is frequently mishandled by non-specialized billing teams.

7. Place of Service Codes

Hospitals must use correct POS codes:

22 for outpatient hospital clinics

21 for inpatient services

23 for emergency department

02 or 10 for hospital telehealth

POS 11 (office) must never be used for hospital encounters. Incorrect POS is one of the top system-generated rejections in 2026 and a common issue faced by Ophthalmology Billing Companies working with hospitals.

8. Modifier Cheat Sheet (Hospital Only)

Hospital optometry frequently requires modifiers such as:

-26 for professional component

-TC for technical component

-25 for separate E/M

-59 for distinct procedural service

-RT / -LT for laterality

-50 for bilateral services

-24 for unrelated E/M in global

-57 for decision for surgery

Office of Inspector General actively audits modifier usage, especially overuse of -25 and -59. Improper modifier logic is now one of the highest fraud-risk indicators in optometry medical billing. Access a comprehensive Ophthalmology Billing Codes Cheat Sheet to support compliant billing in your practice now.

9. Refraction Rules (Zero Insurance)

CPT 92015 (refraction) is never covered by Medicare and is almost always excluded by commercial payers.

Hospitals must treat refraction as self-pay, collect upfront, and exclude it from medical claims.

Submitting refraction to insurance leads to automatic denial and payer flagging, which directly affects optometry revenue cycle management performance metrics.

10. Global Period Billing Rules

Certain optometric services fall under surgical global periods. Cataract surgery (66984) carries a 90-day global. YAG capsulotomy (66821) has a zero-day global. Foreign body removal (65205) has a 10-day global.

During global periods:

E/M cannot be billed unless unrelated

Modifier -24 must be applied

Diagnostic tests must support a new diagnosis

Global misuse is a major audit trigger for hospital eye care billing departments.

11. Hospital Denial Trends (2026)

The most common hospital optometry denials occur due to routine ICD-10 usage, missing interpretation reports, incorrect place of service, duplicate imaging, modifier abuse, refraction billed to insurance, and missing laterality or provider signature.

Most of these are detected through AI-based claim scrubbing systems, which is why structured workflows are essential for any reliable Optometry Billing and Coding Cheat sheet.

12. Hospital Optometry Compliance Formula

Every paid claim must follow this logic:

Chief Complaint → Diagnosis → Test → Interpretation → Treatment Plan

If any link is missing, the claim fails medical necessity validation and does not survive payer audits.

This formula is the backbone of compliant optometry revenue cycle management in hospitals.

Looking for Optometry Billing and Coding Cheat Sheet Support?

Hospital optometry billing in 2026 requires precise coding, proper documentation, and strict compliance with payer rules. From visit classification and E/M codes to ICD-10 usage, diagnostics, and modifiers, every step plays a key role in successful reimbursement.

This Optometry Billing and Coding Cheat sheet provides a practical guide to reduce denials, improve claim quality, and support efficient optometry revenue cycle management.

For expert support, our Ophthalmology Billing Services help hospitals streamline billing and coding processes. Contact MBW RCM today to optimize your hospital eye care revenue cycle.

FAQs: Hospital Optometry Billing & Coding

Request for Information

Facing hospital optometry billing challenges, coding errors, or claim denials? An optometry billing expert can help improve coding compliance and reimbursement.

Fill out the form below to connect with a specialist and optimize your optometry billing performance.