Prior Authorization for Bariatric Surgery: A Strategic RCM Priority

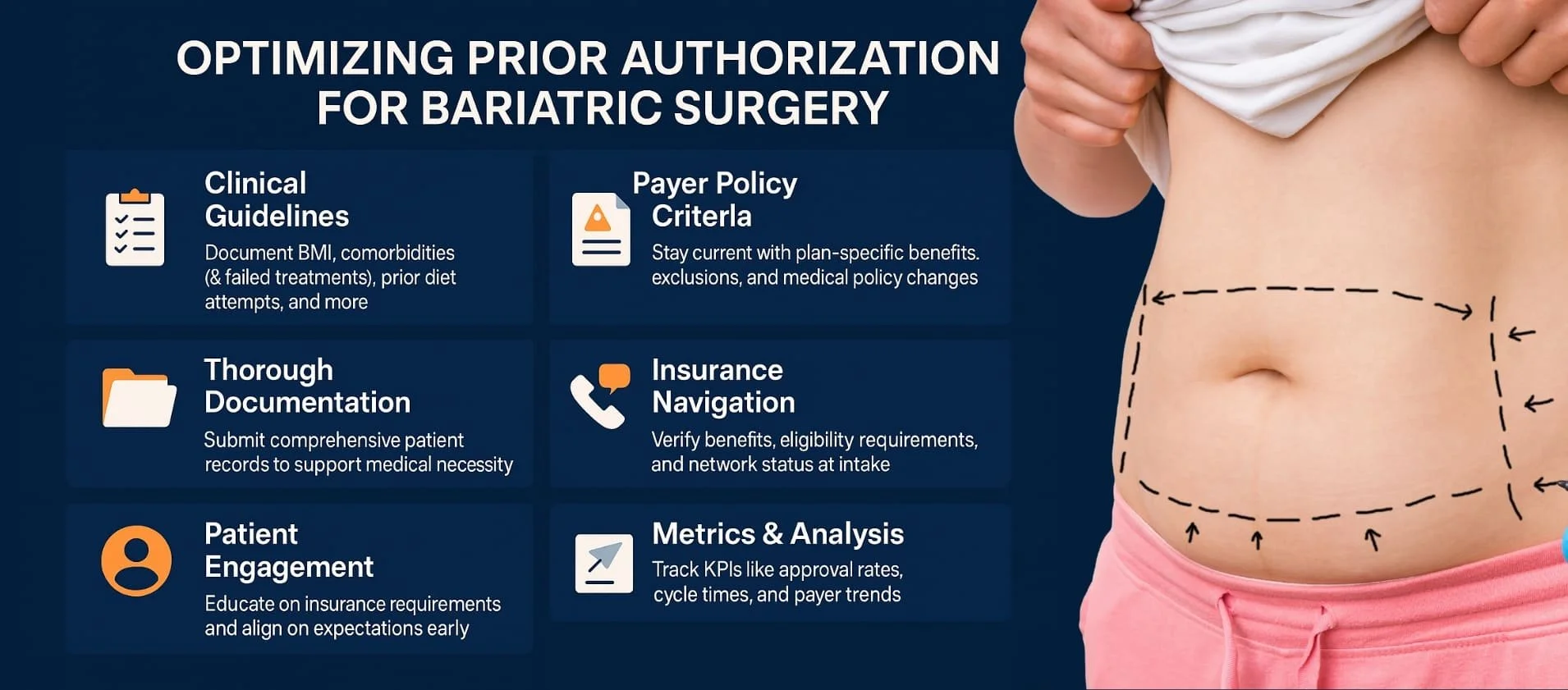

Bariatric surgery offers transformative clinical outcomes—but only when payers approve. For providers and revenue cycle leaders, pre-authorization (pre-auth) is both a regulatory necessity and a strategic financial lever. At MBW RCM, we’ve helped organizations streamline bariatric workflows, reduce denials, and accelerate time to revenue through documentation rigor, payer-specific processes, and KPI-led performance.

This guide offers a detailed, research-backed perspective on optimizing prior authorization for bariatric surgery, combining real-world payer requirements with operational best practices that protect revenue, ensure compliance, and improve patient access.

Need help optimizing your pre-auth workflows? Schedule a free RCM consultation »

Table of Contents

Understand the Payer Landscape: Documentation Drives Dollars for Bariatric Surgery

In the world of bariatric surgery, insurance approval hinges on meeting specific, evolving criteria set by commercial payers and CMS. Every insurer expects a clear, complete demonstration of medical necessity—and that means the right documentation must be gathered and submitted from day one. Below are the five documentation pillars universally required by payers, along with the strategic context behind each.

1. BMI Eligibility

Eligibility begins with BMI thresholds, which signal the medical necessity of surgical intervention. Most payers adhere to these standards:

BMI ≥40: This represents severe obesity and qualifies as a standalone indicator.

BMI ≥35 with one or more serious comorbidities: Includes conditions such as type 2 diabetes, hypertension, or obstructive sleep apnea (OSA), which significantly increase health risks.

Why it matters: These BMI cutoffs align with evidence-based treatment guidelines. Documenting this clearly in the patient chart is foundational to medical necessity.

2. Objective Comorbidity Verification

Insurers require direct proof that the patient’s health is compromised by obesity-related diseases. Acceptable documentation includes:

Diagnostic test results (e.g., HbA1c for diabetes, sleep studies for OSA)

Physician notes confirming diagnosis and clinical relevance

Why it matters: Lack of objective evidence is a top denial driver. Insurers must see the measurable clinical justification for surgery.

3. Supervised Weight Loss Attempts

Most insurers mandate a track record of attempted non-surgical weight loss, documented over 6–12 months. This must include:

Progress notes from medically supervised diet/exercise plans

Pharmacologic interventions or structured weight management programs

Why it matters: This requirement demonstrates the patient’s prior compliance and failure to lose sufficient weight through conservative methods—a necessary precursor to surgical approval.

4. Psychological & Nutritional Readiness

Surgical success depends heavily on mental and nutritional preparedness. Payers expect:

Formal psychological evaluations that rule out contraindications (e.g., untreated psychiatric illness, active substance abuse)

Nutritionist assessments confirming understanding of lifestyle changes post-surgery

Why it matters: These assessments ensure that the patient is both medically and behaviorally ready for long-term change—essential for sustained weight loss and payer confidence.

5. Coverage Specifics

Beyond clinical qualifications, payers impose administrative filters that must be met:

Procedure limitations: Some plans don’t cover all surgery types or revisions.

Network restrictions: Approval is contingent on using in-network providers and facilities.

Waiting periods: A 2–3 year post-enrollment delay may apply for some policies.

Why it matters: Overlooking these details can result in instant denial, even with perfect clinical documentation. Always verify coverage, network status, and policy-specific terms up front.

📌 MBW RCM Tip: Build a payer matrix outlining exact requirements for BMI, comorbidities, supervised weight loss, assessments, and administrative rules. This helps ensure pre-auth readiness before the case is scheduled.

MBW Documentation Checklist: No Submissions Without It

To maximize claim approval and minimize delays, ensure each bariatric case includes:

- ✅ Verified patient and policy details

- ✅ Complete medical and surgical history

- ✅ Pre-op labs, imaging, and specialist notes

- ✅ Direct comorbidity verification via diagnostics

- ✅ Weight loss program documentation

- ✅ Mental health and nutritional evaluations

- ✅ Physician attestation and medical necessity narrative

- ✅ In-network confirmation for provider/facility

The Strategic Stakes: Why Pre-Auth Is an Enterprise Issue

Bariatric pre-authorization is not simply a clinical hurdle—it’s a high-leverage opportunity to influence an organization’s financial health, compliance standing, and patient satisfaction. Its importance extends far beyond insurance paperwork: it’s a critical inflection point that affects every phase of the revenue cycle, from scheduling to final payment.

When pre-auth is approached reactively or inconsistently, organizations experience revenue leakage, compliance exposure, and reputational damage. Conversely, proactive management of bariatric pre-auth enables predictable cash flow, streamlined operations, and a more competitive patient experience.

Key Financial Risks

Denials & Write-Offs: Bariatric cases are highly scrutinized by payers. Missing just one document—such as a psychological evaluation or weight loss program record—can lead to claim rejection. This often results in revenue write-offs or delayed recovery through appeals.

A/R Strain: Each instance of incomplete or delayed pre-auth can add weeks or months to the claims process, inflating average A/R days and straining liquidity. This impairs forecasting, budgeting, and working capital management.

Audit Exposure: Bariatric surgeries are among the top procedures flagged for payer and CMS audits. Poor documentation practices increase risk of recoupments, fines, and reputational harm.

Patient Attrition: Patients facing administrative delays, denied approvals, or coverage confusion may abandon surgery altogether—or seek care from more streamlined competitors. This erodes both patient trust and lifetime revenue potential.

📌 MBW RCM Insight: Treating pre-auth as a high-impact financial process—not just an administrative formality—positions RCM teams as strategic revenue stewards rather than back-office gatekeepers.

Optimize with Metrics: Manage What You Measure

In a pre-authorization process as detail-sensitive as bariatric surgery, metrics aren’t just helpful—they’re essential. The ability to track and benchmark key performance indicators (KPIs) allows RCM leaders to diagnose issues early, optimize workflows, and justify process investments with data.

At MBW RCM, we guide clients toward using metric-based governance to elevate their pre-auth strategy. Monitoring these KPIs turns every pre-auth into an opportunity to improve revenue capture, shorten A/R timelines, and reduce compliance risk.

| Metric | Why It Matters | Target |

|---|---|---|

| Denial Rate (Bariatric) | Identifies documentation shortfalls and workflow inconsistencies | <15% |

| Avg. Pre-Auth Turnaround | Influences scheduling efficiency, OR utilization, and billing timelines | ≤5 business days |

| First Appeal Success Rate | Measures quality and completeness of the initial submission | >60% |

| Claims Paid Without Appeal | Reflects the strength of up-front documentation and payer compliance | >90% |

| Revenue at Risk (Denied $) | Reveals potential loss and helps prioritize remediation | Monthly tracked |

📈 MBW RCM Insight: Don’t wait until denials happen. Use denial and pre-auth performance data as a continuous feedback loop for improving training, checklists, and process controls across your RCM stack.

Automate, Integrate, Accelerate

While MBW RCM recognizes the role of technology in modern RCM, our strength lies in applying human expertise to build durable, payer-specific workflows that reduce errors and improve turnaround. Pre-authorization success in bariatric surgery is less about AI or robotic automation, and more about structured coordination, consistent documentation, and cross-functional communication.

We help organizations implement high-touch, service-centered solutions tailored to the human elements of the pre-auth process:

Our Approach:

Embedded EHR Support & Process Mapping – MBW RCM partners with your team to map out payer-specific documentation workflows directly within your EHR, reducing variability and missed requirements.

Hands-On Documentation Review & Support – Our specialists help ensure every pre-auth file is clean, complete, and aligned with each payer’s expectations before submission.

Denial Trend Reporting & Root Cause Review – Human-led analysis of claim outcomes to identify common failure points and develop corrective education or workflow improvements.

Eligibility & Network Verification Protocols – We assist your front office and RCM teams in conducting proactive payer validation checks to confirm coverage and network alignment before scheduling.

Looking for a pre-auth partner that blends expert guidance with payer-savvy execution? Connect with MBW’s human-led RCM specialists »

Operational Playbook: Best Practices for Success

Even with the best tools and checklists in place, successful bariatric pre-authorization depends on disciplined execution and team coordination. Organizations that achieve consistently high approval rates and low denial volumes tend to operate from a shared, structured playbook—one that eliminates variability and promotes accountability at every step.

Here are the core best practices that top-performing bariatric programs follow to ensure alignment, compliance, and results:

Standardized Pre-Auth Bundles. Create payer-specific pre-auth templates that include all required documentation. These should be embedded into EHR workflows to ensure front-line staff can easily access and complete them in real time.

Digital Checklists. Deploy dynamic, digital checklists mapped to each payer’s documentation rules. Require completion before submission or scheduling, and assign accountability to specific roles within the workflow.

Real-Time Collaboration. Foster seamless communication between clinical providers, administrative teams, and RCM staff. Timely updates and shared access to pre-auth materials prevent delays and support faster turnaround.

Quarterly Training. Conduct regularly scheduled training that emphasizes emerging trends in payer policy, examples of real-world denials, and tactical remediation steps. Keep staff informed and agile in the face of changing requirements.

Continuous Improvement. Audit denied or delayed pre-auth cases monthly. Use root-cause analysis to identify upstream process failures, documentation oversights, or payer-specific nuances that need to be addressed.

A Financial Perspective: Real Dollars, Real Impact

Pre-authorization isn’t just a procedural checkpoint—it’s a bottom-line driver. For bariatric surgery programs, the financial implications of denial rates, delayed approvals, or documentation missteps can be substantial. Every missed requirement or delayed submission translates into real, measurable revenue loss.

Let’s consider a typical medium-volume program performing 300 bariatric surgeries annually. At an average reimbursement of $15,000–$20,000 per procedure, even a small reduction in the denial rate can have an outsized impact on financial performance:

Reducing pre-auth denials from 28% to 10% translates to $500,000+ in recovered or accelerated revenue.

Fewer denials mean less time spent on appeals, faster reimbursements, and lower administrative overhead.

Improved front-end processes reduce A/R cycle times, bolstering working capital and predictability in monthly revenue forecasting.

Better patient experience from seamless approvals enhances retention and drives reputation-based growth through referrals.

The cumulative effect is clear: pre-auth optimization offers both direct financial return and strategic positioning for growth.

Executive Takeaway

Pre-authorization is no longer a back-office task—it’s a strategic RCM function. For bariatric surgery, payer-specific documentation, hands-on process coordination, and performance tracking aren’t optional. They are the foundation of predictable revenue, faster reimbursements, and long-term operational stability.

At MBW, we help clients turn this challenge into competitive advantage.

Let’s reduce denials, improve turnaround, and capture lost revenue—together. 📞 Book your strategy call with MBW RCM.