How to Evaluate a California Medical Billing Company in 2025

Are you searching for a reliable medical billing company in California but unsure how to assess your options? In a state as large and regulated as California, choosing the right billing partner isn't just helpful—it’s necessary for your practice’s growth and compliance.

- Key Factors to Evaluate

- 1. Experience with California Payers and Compliance

- 2. EHR and Practice Management Integration

- 3. Transparent Pricing Structure

- 4. Support Availability and Location

- 5. Reviews, Referrals, and Client Testimonials

- Bonus Tip: Trial or Audit

- Why MBW RCM Should Be on Your Shortlist

- Free Practice Billing Analysis

- Final Thoughts

- FAQs

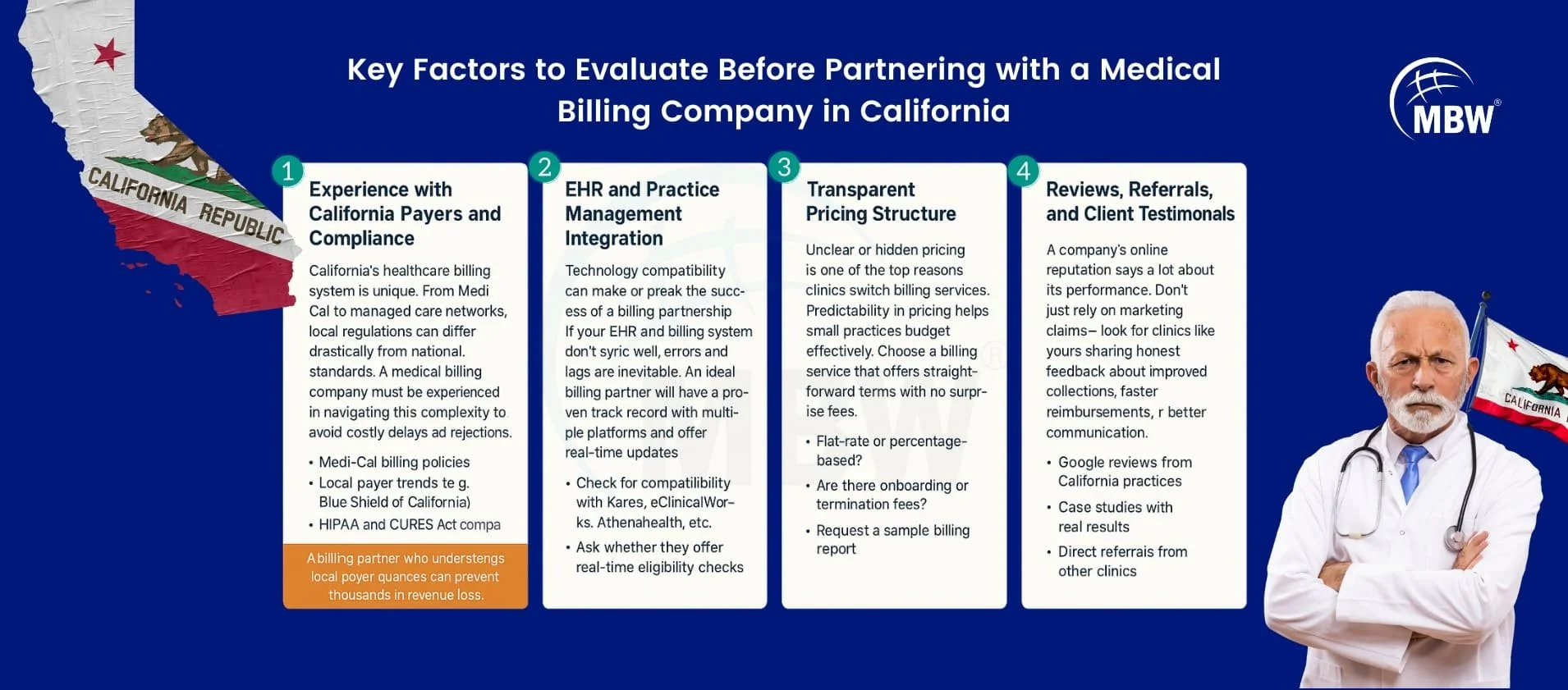

Key Factors to Evaluate Before Partnering with a Medical Billing Company in California

When evaluating a medical billing company in California, several non-negotiables can determine your billing outcomes. Let’s break down what to look for in your next revenue cycle partner.

1. Experience with California Payers and Compliance

California’s healthcare billing system is unique. From Medi-Cal to managed care networks, local regulations can differ drastically from national standards. A medical billing company must be experienced in navigating this complexity to avoid costly delays and rejections. California's insurance environment includes commercial plans, Medi-Cal, and multiple regulatory layers. The billing company should be fluent in:

Medi-Cal billing policies

Local payer trends (e.g., Blue Shield of California)

HIPAA and CURES Act compliance

"A billing partner who understands local payer nuances can prevent thousands in revenue loss."

2. EHR and Practice Management Integration

Technology compatibility can make or break the success of a billing partnership. If your EHR and billing system don’t sync well, errors and lags are inevitable. An ideal billing partner will have a proven track record with multiple platforms and offer real-time updates. Does the billing company work with your current EHR? Integration ensures fewer delays and smoother workflows.

Check for compatibility with Kareo, eClinicalWorks, Athenahealth, etc.

Ask whether they offer real-time eligibility checks

Look for daily claims reporting and rejection alerts

3. Transparent Pricing Structure

Unclear or hidden pricing is one of the top reasons clinics switch billing services. Predictability in pricing helps small practices budget effectively. Choose a billing service that offers straightforward terms with no surprise fees. Avoid billing companies that hide their fees or use complicated structures.

Flat-rate or percentage-based?

Are there onboarding or termination fees?

Request a sample billing report

4. Support Availability and Location

Support isn’t just about answering emails—it’s about solving problems when they happen. A responsive, U.S.-based team that works during your clinic hours provides peace of mind, especially during claims or audit reviews. Many billing firms outsource support. Ask:

Is your account manager U.S.-based?

Are they available during your business hours?

Can they join payer calls when needed?

5. Reviews, Referrals, and Client Testimonials

A company's online reputation says a lot about its performance. Don't just rely on marketing claims—look for clinics like yours sharing honest feedback about improved collections, faster reimbursements, or better communication. Look beyond the website. Seek:

Google reviews from California practices

Case studies with real results

Direct referrals from other clinics

Ask for a Trial or Audit

If you're unsure about committing to a new billing service, a trial or audit period can be incredibly revealing. It allows you to evaluate service quality, transparency, and compatibility with your workflow—without risk. A 90-day audit helps identify billing inefficiencies and uncover revenue gaps that might be costing your practice thousands.

See how your current billing stacks up and get expert insight into reclaiming missed reimbursements. Some billing companies offer a free audit of your last 90 days of claims. This can:

Uncover hidden revenue gaps

Reveal denial trends

Assess compliance weaknesses

👉 Get a Free Practice Audit from MBW RCM – Know where your billing stands and what can be improved before you sign a contract.

Why MBW RCM Should Be on Your Shortlist

If you're evaluating billing companies in California, consider starting with MBW RCM’s medical billing services for California practices. They offer deep experience with state payers, integrate with 15+ EHRs, and provide flexible pricing suited for clinics of all sizes. Their responsive U.S.-based team helps reduce denials and supports both general and specialty practices.

Get a Free Practice Billing Analysis from MBW RCM

MBW RCM offers a no-obligation billing performance analysis tailored for California clinics. Discover where you're losing revenue, how to fix it, and what a local, integrated partner can offer.

👉 Request Your Free Billing Audit – Analyze claim trends, EHR compatibility, and payer issues with one click.

Choose a Partner, Not Just a Vendor

The right medical billing company in California should feel like an extension of your team. Evaluate based on real-world support, not just promises on a webpage.

Ready to compare top-rated billing providers in California? Explore our full list of vetted partners to see who fits your workflow, EHR, and specialty.