How to Prepare for a Medicare Risk Adjustment Data Validation (RADV) Audit

Medicare’s Risk Adjustment Data Validation (RADV) audits are designed to verify the accuracy of submitted Hierarchical Condition Category (HCC) codes. While they are a compliance necessity, the financial stakes are high—organizations found non-compliant may face significant clawbacks, penalties, and reputational harm. Preparing in advance is the best defense.

This guide offers practical strategies to help healthcare organizations avoid penalties, strengthen compliance, and safeguard revenue.

Table of Contents

1. Understanding RADV Audits

What it is:

RADV audits are formal reviews where CMS compares risk adjustment diagnosis codes (HCCs) submitted by a healthcare organization to the actual documentation in the patient’s medical record. The goal is to verify that each diagnosis billed is clinically supported, documented, and coded with precision. These audits can cover both prospective and retrospective data, and may involve statistical sampling that extrapolates findings across large populations.

Why it matters:

Financial implications: Unsupported diagnoses can trigger repayment demands (clawbacks) that may reach into the millions.

Compliance risks: Repeated or systemic errors can lead to heightened regulatory oversight, corrective action plans, and even fraud investigations.

Reputation and trust: Accurate documentation fosters confidence with CMS, payers, and patients, ensuring both financial stability and long-term credibility.

Operational readiness: Understanding RADV audits early allows organizations to integrate audit preparedness into everyday coding and documentation practices, reducing last-minute fire drills.

If you are interested to read more about Medicare, please have a look at this blog on ‘‘Understanding Payer-Specific Credentialing: Medicare vs. Commercial Insurance’’.

2. Know the Rules and Guidelines

Compliance begins with knowing what auditors expect.

ICD-10-CM specificity: Always use the most specific codes (avoid “unspecified” unless medically appropriate).

Annual recapture: Chronic conditions must be coded and supported at least once per calendar year.

Documentation alignment: Codes must be fully supported in the medical record—verbal assumptions or implied conditions won’t pass validation.

Expanded Guidance:

Auditors pay particular attention to:

Chronic conditions such as diabetes, COPD, and heart failure—these must show current, ongoing management.

“Suspect” diagnoses like depression, CKD, or cancer where documentation often falls short of MEAT standards.

Combination codes (e.g., diabetes with complications) which must be explicitly linked in provider notes.

Laterality and stage/severity for conditions like pressure ulcers, CKD, or heart failure.

Hospital and specialist notes: Ensure diagnoses are consistently documented across all settings, not just primary care.

By staying ahead on these high-risk areas, practices can dramatically reduce their exposure to audit penalties and clawbacks. For additional support, providers can reference trusted diagnosis and procedure coding resources to stay aligned with industry standards.

3. Building a Documentation and Coding Culture

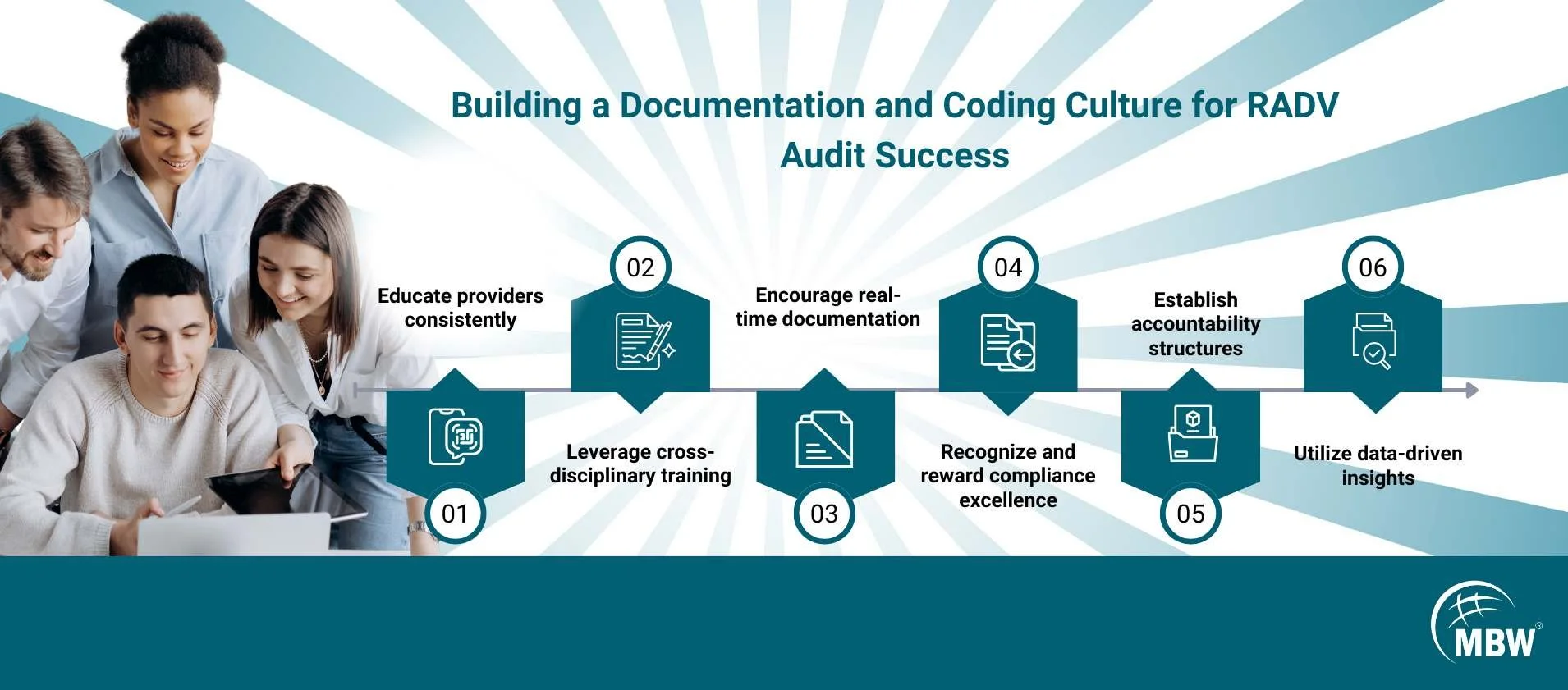

Audit readiness isn’t a one-time project—it’s a cultural shift that requires sustained commitment at every level of the organization. A strong culture of documentation and coding excellence minimizes compliance risks, maximizes reimbursement, and makes audit preparation a natural byproduct of daily practice.

Educate providers consistently: Offer ongoing training sessions on documentation best practices, CMS guidelines, and emerging RADV hot spots. Reinforce the financial and compliance impact of accurate coding.

Master and apply the MEAT criteria: Providers should be fluent in the Monitoring, Evaluation, Assessment, and Treatment framework for every chronic condition. Using MEAT as a standard reduces ambiguity and ensures clinical notes are defensible in an audit.

Encourage real-time documentation: Promote immediate documentation during or directly after the patient encounter. Real-time notes reduce the risk of omissions and support more precise HCC capture.

Integrate compliance into daily workflows: Create checkpoints where coders, billers, auditors, and clinicians collaborate before claim submission. Use peer reviews or concurrent coding checks to catch errors early.

Establish accountability structures: Assign compliance champions in each department to monitor adherence, provide feedback, and keep audit readiness top of mind.

Leverage cross-disciplinary training: Help coders understand clinical nuances and providers understand coding requirements. This shared knowledge fosters collaboration and reduces disconnects.

Recognize and reward compliance excellence: Incentivize staff who consistently demonstrate high-quality documentation and coding accuracy. Positive reinforcement reinforces the culture.

By embedding these practices into the organization’s DNA, healthcare teams move beyond audit preparedness to create a proactive culture of compliance and financial stewardship.

Building this culture also means focusing on the accuracy of HCC coding, since it directly impacts compliance, reimbursement, and patient outcomes. Organizations that prioritize accurate HCC coding are better positioned to improve patient care while staying audit-ready.

4. Conduct Internal Mock Audits

One of the most effective strategies to stay prepared for RADV audits is to conduct thorough internal mock audits on a regular basis. These audits simulate the CMS process and reveal weak points before an actual review.

Random sampling: Select patient records in a way that mirrors CMS statistical sampling, ensuring a representative picture of coding quality across the practice.

Independent review: Engage compliance staff, external auditors, or a neutral internal team to validate codes against clinical documentation, eliminating bias.

Identify gaps: Go beyond surface checks by assessing coding accuracy, documentation sufficiency, adherence to MEAT standards, and consistency across providers and settings.

Correct proactively: Translate findings into action by retraining staff, updating workflows, and enhancing templates or EHR prompts. Ensure corrective actions are documented and tracked for improvement over time.

Trend analysis: Compare findings from multiple rounds of mock audits to detect systemic issues, recurring documentation errors, or chronic under‑coding/over‑coding trends.

Readiness reporting: Develop summary reports for leadership that highlight strengths, risks, and progress over time, reinforcing accountability and readiness.

5. Leverage Technology and Tools

Smart use of technology can streamline audit preparedness, but it requires more than just basic tools—it requires thoughtful integration into daily operations.

EHR prompts and templates: Encourage thorough documentation at the point of care, using condition‑specific prompts and auto‑population features that reduce human error.

AI-assisted coding tools: Use advanced natural language processing systems to flag missing, ambiguous, or under‑documented conditions. These tools can also suggest MEAT elements, improving clinical defensibility.

Dashboards and reporting: Deploy interactive dashboards that track RAF scores, coding accuracy, provider performance, and audit outcomes in real time. Include trend analysis to highlight recurring problem areas.

Automated alerts: Configure systems to notify compliance teams when documentation gaps or missed recapture opportunities occur.

Data mining tools: Apply analytics to identify high‑risk HCC categories most likely to be challenged in a RADV audit.

Audit trail systems: Ensure every change, correction, or late entry is logged for transparency, which auditors often review closely.

6. Create a RADV Audit Response Plan

Even with preparation, audits may come. Be ready with a playbook:

Centralized coordination: Assign a compliance lead to manage requests, timelines, and communication with CMS.

Document management: Keep a secure repository for medical records, coding documentation, and prior audit responses.

Communication protocols: Ensure providers and staff understand the importance of timely, accurate responses.

Legal and compliance oversight: Involve legal experts if high financial risks are identified.

The Bottom Line

RADV audits are unavoidable—but they don’t have to be devastating. By strengthening documentation, building audit-ready systems, and leveraging professional coding expertise, organizations can not only pass audits but also ensure they’re being paid appropriately for the care they deliver.

The bottom line: Compliance protects revenue. Accuracy protects reputation. Together, they create a resilient, audit-proof revenue cycle.

MBW RCM Call-to-Action

Ready to strengthen your compliance and protect your revenue? MBW RCM’s expert team specializes in HCC coding services, audit readiness, and revenue cycle optimization. Whether you need a mock audit, training, or full-scale coding support, we help you stay compliant and maximize reimbursement.

📞 Contact MBW RCM today to safeguard your practice’s revenue cycle before CMS comes knocking.