The Credit Balance Conundrum: A Hidden Source of Revenue Cycle Risk

In the world of healthcare billing, there’s a persistent myth: that a credit balance is a “good problem to have.” Many assume it’s a small surplus in revenue—a little extra cash in the bank. It’s often dismissed with a shrug and a “we’ll deal with it later” mentality.

But this couldn’t be further from the truth. Credit balances are not free money—they are liabilities. Left unresolved, they present a compliance risk, distort financial reporting, frustrate patients, and even obscure the real picture of your Accounts Receivable (A/R).

This blog will break down how credit balances happen, why they create risk at multiple levels, the impact on compliance, reporting, patients, and A/R, and best practices to resolve and prevent them.

Table of Contents

What Is a Credit Balance?

A credit balance arises when the total of posted payments and adjustments is greater than the charges on an account. This does not represent a windfall for the practice but rather indicates that funds belong to someone else—typically the patient, the payer, or in some cases another responsible party. In other words, it is an obligation, not extra revenue.

Credit balances generally fall into four categories: patient overpayments (for example, a patient pays at the time of service and insurance later covers the same amount), payer overpayments or coordination-of-benefits errors, posting mistakes such as misapplied or duplicated payments, and payer recoupments that are entered incorrectly into the ledger. Each scenario may look different, but all create the same result: money that must be refunded or properly reconciled.

How Do Credit Balances Happen?

Credit balances usually trace back to one of four root causes, each of which can have multiple variations and downstream effects that ripple through the revenue cycle.

Patient Overpayments – This often occurs when patients pay at the time of service, expecting to owe a deductible or co-insurance, but insurance later covers more than anticipated. In some cases, patients also make online portal payments in addition to what they paid in person, doubling their contribution.

Duplicate Payments from Payers – Coordination of benefits between primary and secondary payers can lead to both carriers paying for the same charge. Sometimes even the same insurer accidentally processes and pays the claim twice due to system or claim re-submission errors.

Incorrect Posting – Human error plays a large role: payments can be posted to the wrong account, applied to the wrong date of service, or double-posted. Misapplied contractual adjustments may also inflate balances incorrectly.

Payer Recoupment Requests – If a payer requests funds back and the recoupment is not entered correctly, the system may show a lingering credit balance rather than a cleared transaction. In some cases, staff may issue a manual refund without offsetting the ledger entry, creating phantom credits.

Individually, these errors may seem minor or easily correctable, but across hundreds or thousands of patient accounts, the financial exposure grows rapidly. The cumulative effect not only increases compliance risk but also distorts the accuracy of reporting and complicates daily operations.

Why Credit Balances Are a Serious Risk

1. Compliance and Audit Exposure

Unresolved credit balances draw regulatory scrutiny:

CMS Form 838 requires quarterly reporting of Medicare credit balances.

The OIG routinely audits providers with large unresolved balances, viewing them as poor internal controls or potential fraud.

Under the ACA 60-day rule, Medicare/Medicaid overpayments must be returned within 60 days of identification—or providers risk False Claims Act liability.

What feels like a bookkeeping issue can quickly become a compliance violation with steep penalties.

2. Inaccurate Financial Reporting

Credit balances inflate reported revenue and distort financial health:

They create a false sense of profitability.

Liabilities are understated, confusing leadership decisions.

A/R data integrity suffers, skewing collections forecasting.

A practice with $100,000 in unworked credit balances doesn’t have “extra cash”—it has a six-figure liability on its books.

3. Patient Dissatisfaction

Patients view credit balances as their money—and they’re right.

Slow or confusing refund processes erode trust.

Negative experiences around billing often outweigh positive clinical care in shaping loyalty.

In some cases, patients escalate complaints to insurance regulators or consumer protection agencies.

In today’s patient-consumer environment, a poorly handled refund can cost more in lost goodwill than the balance itself.

4. The A/R Challenge

Credit balances clutter your Accounts Receivable (A/R) reports:

They hide the true picture of outstanding claims.

Staff may waste time working on already-paid encounters.

Efforts to reduce aging claims are undermined when balances are artificially inflated.

Instead of supporting efficiency, unresolved credits act as static in the signal—making it harder to identify at-risk claims.

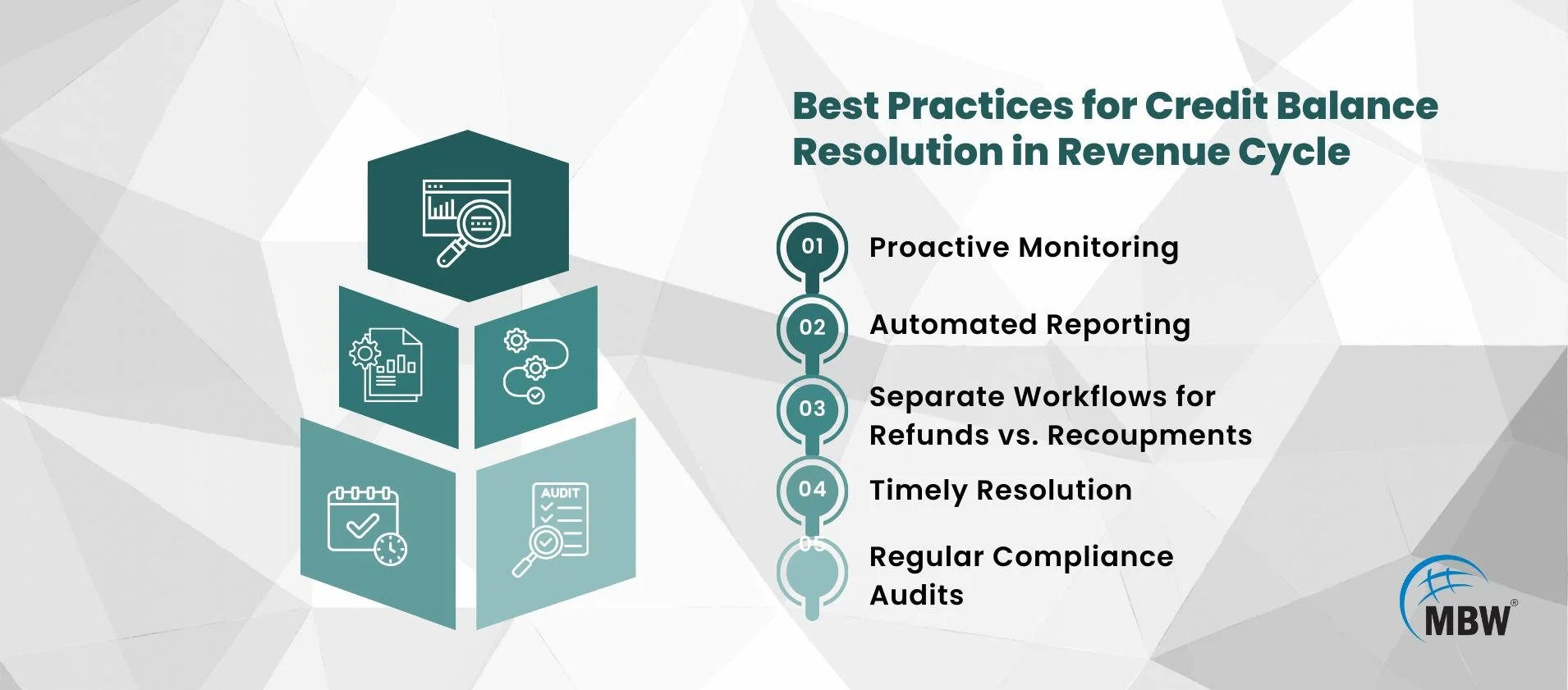

Best Practices for Credit Balance Resolution

The most effective way to resolve credit balances is through a structured and disciplined process. Below are detailed best practices:

Proactive Monitoring – Organizations should run credit balance reports on a regular basis—monthly at minimum, or weekly for high‑volume practices. Waiting until quarter‑end or an external audit to uncover issues often results in preventable compliance risks and larger clean‑up projects.

Automated Reporting – Leverage the reporting functions within your practice management or billing system to flag credit balances quickly. Automated alerts for credits that exceed a certain threshold allow leaders to intervene early, minimizing the risk of regulatory exposure or patient frustration.

Separate Workflows for Refunds vs. Recoupments – Patient refunds should be routed through a straightforward financial workflow that prioritizes timely repayment. Payer refunds or recoupments, however, require additional layers of compliance and sometimes legal review to ensure the funds are returned correctly and documented for audit purposes.

Staff Training – Revenue cycle staff must understand the difference between contractual and non‑contractual adjustments and be familiar with payer‑specific policies. Regular education sessions, supported with real account examples, help prevent repeated errors and improve posting accuracy.

Timely Resolution – Patient refunds should generally be issued within 30 to 60 days of identification. For payer recoupments, documentation must be entered into compliance logs promptly to demonstrate adherence to regulations and to provide a clear audit trail.

Regular Compliance Audits – Internal audits should benchmark processes against CMS standards and any state‑specific requirements. A best practice is to periodically select a sample of resolved credit balances and trace them from identification through final resolution to ensure that policies are consistently applied and compliant handling is maintained.

Turning Risk Into Opportunity

When organizations proactively manage credit balances, they can transform a potential liability into a competitive edge. Effective strategies strengthen compliance programs, improve financial clarity, and enhance patient relationships. In practical terms, this means:

Regulatory readiness – Consistent processes reduce audit exposure and demonstrate strong internal controls.

Financial transparency – Accurate, timely resolution produces more reliable reporting and a clearer picture of Accounts Receivable.

Patient trust – Quick, clear communication and timely refunds reinforce patient confidence and loyalty.

Rather than viewing credit balances as a “good problem,” they become an opportunity to show operational discipline, protect financial health, and elevate the patient experience.**

For further insights on compliance considerations, see this resource on revenue cycle credit balances.

Conclusion: Don’t Let Credit Balances Linger

Credit balances aren’t minor nuisances—they are signals of deeper revenue cycle inefficiencies and potential liabilities. By treating them with urgency, building preventive workflows, and training staff effectively, practices can reduce risk, protect financial integrity, and improve patient satisfaction.

At MBW RCM, we partner with practices to create proactive credit balance management strategies—turning hidden risks into opportunities for growth.