How To Verify Patient Insurance Eligibility Verification

Patient Insurance Eligibility Verification is a structured administrative process used by healthcare providers to confirm whether a patient’s insurance coverage is active and applicable before services are delivered. According to CMS operational guidance, eligibility data should be validated within 72 hours prior to the date of service to reduce downstream claim issues and administrative rework. This blog explains how patient eligibility is verified by describing the steps and validation checks used during eligibility review.

Table of Contents

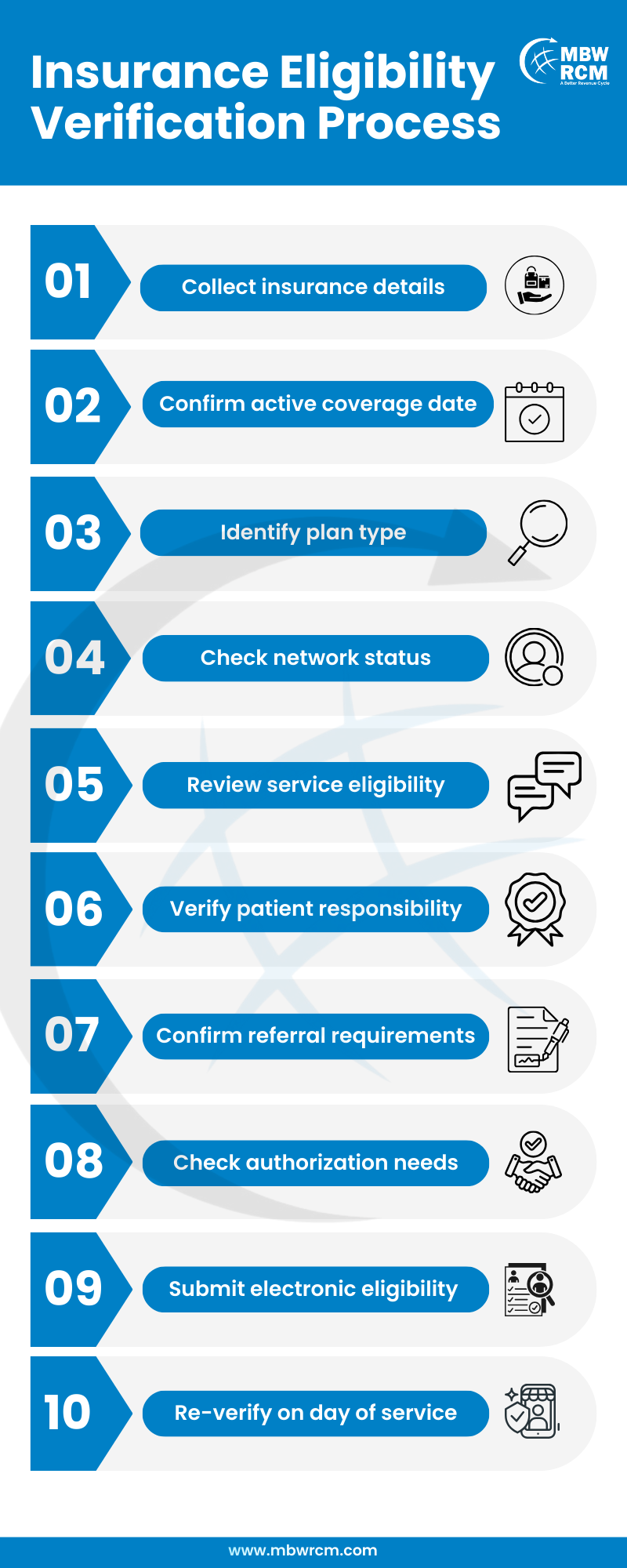

Steps Involved in Patient Insurance Eligibility Verification

The verification process follows a defined sequence to confirm coverage details before services are provided. Each step focuses on reviewing payer data, benefit rules, and service-level requirements that affect scheduling, patient responsibility, and claim submission. Completing these steps helps reduce coverage-related issues and supports consistent eligibility outcomes across patient visits.

1. Initial Intake Of Insurance And Patient Details

The process begins with collecting patient demographics and insurance identifiers during registration. This includes legal name, date of birth, policy number, group number, and payer name. Any mismatch at this stage can disrupt patient insurance verification, as payer systems rely on exact data matching to return eligibility responses.

2. Validating Active Policy Dates Before Services

Coverage must be active on the exact service date. Insurance policies often reset annually on January 1, while changes can also occur during open enrollment periods between November and January. Validating dates is essential to verify patient insurance coverage before appointments are finalized and aligns with standard benefit verification in medical billing steps followed during eligibility review.

3. Confirming Coverage For Scheduled Procedures

After confirming active coverage, the next step is determining whether the planned service is included under the policy. An insurance eligibility check helps identify covered versus excluded services, particularly for diagnostics, imaging, or specialty procedures that may have restrictions.

4. Reviewing Visit Limits And Frequency Rules

Many payer plans enforce visit caps, such as 20–30 therapy visits per calendar year or condition-based frequency limits. Reviewing these rules supports patient eligibility verification by ensuring remaining benefits are available for the scheduled visit.

5. Identifying Patient Cost Responsibility

Cost-sharing details such as copays, deductibles, and coinsurance must be reviewed in advance. For example, high-deductible health plans often require patients to meet deductibles ranging from $1,500 to $5,000 before coverage applies. This step aligns with eligibility verification before billing and supports informed patient communication.

6. Confirming Provider Network Participation Status

Network status directly affects reimbursement rates and patient responsibility. Verifying whether a provider is in-network or out-of-network is a core step in insurance verification in healthcare, as out-of-network services may lead to reduced payer payment or higher patient liability.

7. Checking Referral And Authorization Requirements

Certain plans require referrals or prior authorizations for specialty services. These requirements are especially common in HMO plans and must be identified early as part of patient insurance eligibility verification to prevent service delays or claim denials.

8. Accessing Eligibility Information Through Payer Portals

Most commercial and government payers offer online portals that provide real-time eligibility responses. These portals are commonly used to perform an insurance eligibility check, returning data such as coverage status, benefit summaries, and authorization indicators within seconds.

Comparison of Eligibility Verification Methods:

9. Contacting Insurance Providers For Manual Confirmation

When portal responses are incomplete or unavailable, payer calls may be required. Manual confirmation remains a necessary option within the eligibility verification process in medical billing, particularly for complex benefit structures or secondary coverage scenarios.

10. Using Automated Systems For Faster Eligibility Checks

Automated tools integrate practice systems with clearinghouses and payer databases, returning responses in under 30 seconds on average. These tools are widely used for eligibility verification in revenue cycle management to reduce manual workload and turnaround time.

11. Rechecking Coverage On The Day Of Service

Coverage changes can occur without notice. Rechecking eligibility on the day services are rendered confirms coverage remains active and supports an accurate patient eligibility check immediately before care delivery.

12. Documenting Verification Results For Billing Use

Verification outcomes should be documented with confirmation numbers, timestamps, and payer responses. Proper records support patient eligibility verification for claims and help billing teams resolve post-submission inquiries efficiently.

13. Resolving Common Eligibility Discrepancies

Common discrepancies include inactive policies, incorrect subscriber IDs, or exhausted benefits. Addressing these issues promptly helps maintain consistency across Patient Insurance Eligibility Verification workflows and reduces avoidable claim rework. unnecessary claim rework by avoiding common eligibility verification mistakes and how to avoid them during the review process.

Common Eligibility Issues and Required Follow-Up:

Repeating Verification For Every Patient Visit

Eligibility verification should be repeated for every visit, as benefits, coverage status, and coordination of benefits can change between appointments. This practice strengthens Patient Insurance Eligibility Verification reliability over time.

What to Check During Patient Insurance Verification

During the verification stage, coverage details must be reviewed against payer responses to confirm whether insurance applies to the scheduled date of service. This review focuses on payer-returned data fields that directly affect appointment handling, patient responsibility, and claim submission readiness.

Coverage elements that must be checked include:

Policy effective date and termination date returned by the payer

Subscriber and patient demographic match against payer records

Insurance plan type and benefit category assigned to the policy

Coverage availability for the scheduled procedure or visit type

Remaining visit count or service frequency limits for the benefit period

Copay amount applicable to the specific visit classification

Remaining deductible balance and coinsurance percentage

Rendering provider and facility network participation status

Referral indicators for specialty services, if applicable

Prior authorization indicators tied to the scheduled service

Primary and secondary payer order when multiple plans exist

Coverage exclusions or service limitations listed in the response

Eligibility confirmation number, response date, and timestamp

Reviewing these payer-specific data points helps teams determine whether services can proceed as scheduled and whether additional actions are required before billing.

How MBW RCM Supports the Patient Insurance Verification Process

MBW RCM supports medical practices and provider groups by using standardized verification workflows aligned with payer rules and documentation requirements. Coverage status, eligibility, and benefit information are reviewed through consistent steps before care is provided, supporting reliable eligibility & benefits verification services.

Verification activities include reviewing payer responses, recording confirmation details, and aligning eligibility findings with scheduling and billing needs. This structured approach helps provider teams complete eligibility checks on time and reduce follow-up issues caused by incomplete or inconsistent verification.

When performed correctly, Patient Insurance Eligibility Verification supports smoother administrative operations, clearer patient expectations, and better billing preparedness across healthcare organizations.

FAQs: Patient Insurance Eligibility Verification

Request for Information

Incomplete or incorrect insurance eligibility checks can result in coverage issues, delayed services, and avoidable billing rework. Complete the form below to receive guidance on verifying patient insurance eligibility, reviewing coverage details, benefits, and payer requirements, and supporting smoother scheduling and billing workflows.