How Eligibility Verification in Revenue Cycle Reduces Claim Denials and Improves Cash Flow

In today’s healthcare environment, eligibility verification in the revenue cycle is no longer optional — it’s a core financial safeguard. Every missed or incomplete eligibility check risks claim denials, payment delays, and patient dissatisfaction. With margins tightening and payers enforcing stricter rules, practices that prioritize verification are directly protecting their bottom line.

According to the 2024 MGMA Financial Performance Report, eligibility and benefit-related issues are the second-leading cause of claim denials in the U.S., accounting for roughly 20% of all rejections. Each denial represents not just delayed payment but also wasted staff time, increased administrative costs, and the very real possibility that the revenue will never be recovered.

Table of Contents

Why Eligibility Verification is important in Revenue Cycle

The revenue cycle begins the moment an appointment is scheduled. If coverage details are inaccurate or incomplete at that point, everything downstream — billing, collections, and even patient satisfaction — can suffer.

The Hidden Costs of Missed Verification:

Rework Expenses: Each denied claim costs $25–$30 to reprocess, excluding the soft costs of disrupted workflows.

Lost Revenue: Up to 65% of denied claims are never recovered.

Longer A/R Cycles: Even corrected denials can stretch payment timelines from 14 days to 60–90 days.

Patient Churn: Unexpected bills often lead to negative reviews and patient loss.

Case Example:

A multi-location orthopedic group in Florida discovered that 1 in 7 denials came from ineligible coverage at the time of service. By instituting a structured pre-visit eligibility verification process, they reduced eligibility-related denials by 57% in six months, recovering more than $380,000 in revenue.

Strengthening this step consistently highlights the broader value of patient eligibility verification before every appointment in reducing denials and protecting revenue.

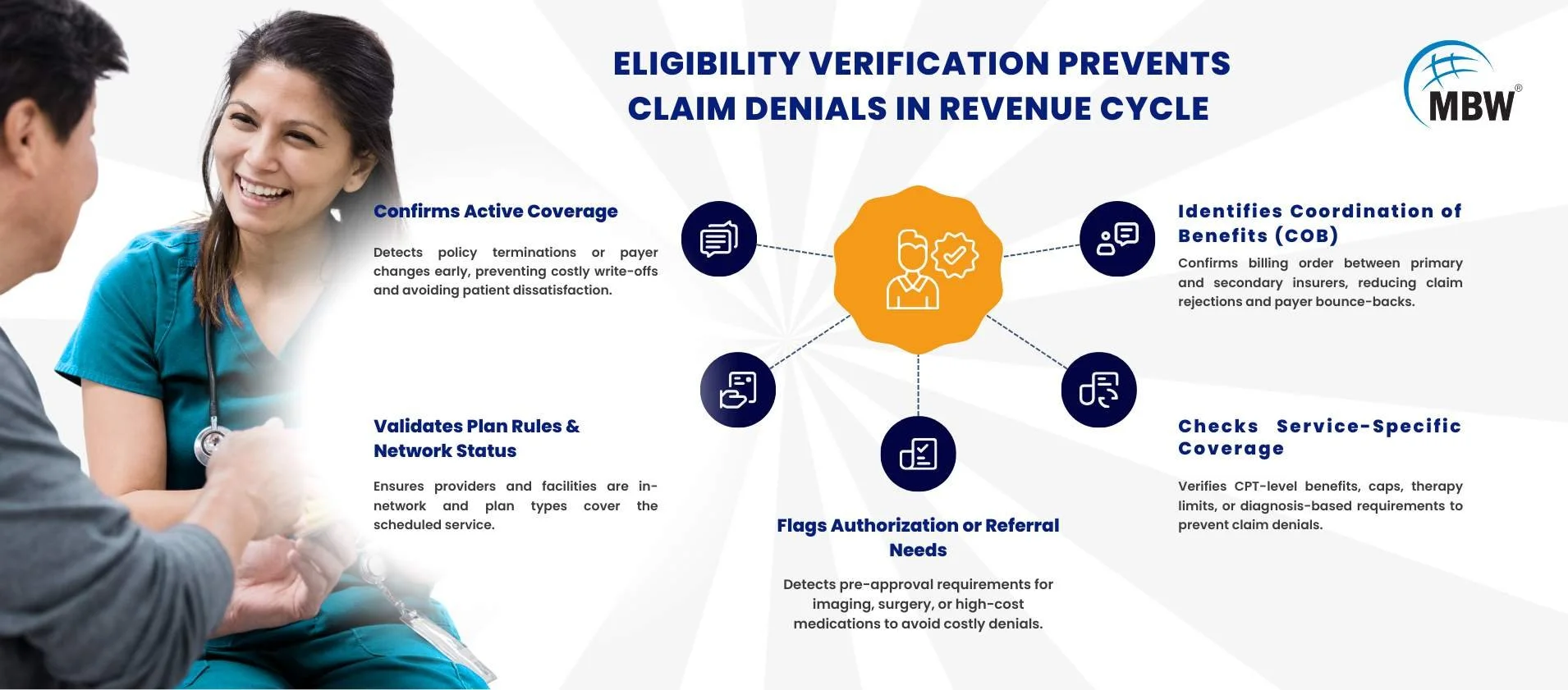

How Eligibility Verification Prevents Claim Denials in Revenue Cycle

A comprehensive eligibility verification process goes far beyond “checking the insurance card.” In fact, eligibility verification is the first step to clean claims, ensuring that all coverage variables are accounted for before the patient arrives.

Confirms Active Coverage

Detects policy terminations, employer network changes, or payer switches before claims are submitted.

Example: Catching a policy termination before the visit avoids both a $1,200 write-off and an upset patient.Validates Plan Rules & Network Status

Confirms whether the provider and facility are in-network and whether the plan type (HMO, PPO, EPO) covers the scheduled service.Identifies Coordination of Benefits (COB)

Ensures correct order of billing between primary and secondary insurers, preventing payer bounce-backs.Checks Service-Specific Coverage

Confirms benefits at the CPT code level, including visit caps, therapy maximums, or diagnosis-specific requirements.Flags Authorization or Referral Needs

Prevents denials caused by missing pre-approvals, which are common for imaging, surgery, and high-cost medications.

The Cash Flow Advantage of Eligibility Verification in Revenue Cycle

Strong verification practices protect more than just claim acceptance rates — they improve overall financial predictability.

Faster Reimbursements: Clean claims are paid on first submission, often within two weeks.

Lower Write-Offs: Eliminates preventable losses from services provided to ineligible patients.

Improved Forecasting: Reliable payment timelines make budgeting and staffing decisions more accurate.

Reduced Patient Billing Conflicts: Clear cost communication upfront builds trust and improves collection rates.

Industry Data Point:

The Change Healthcare 2023 Revenue Cycle Denials Index found that organizations verifying 90%+ of patients in real time saw A/R days up to 20% shorter than those relying on post-service claim fixes.

Best Practices for Eligibility Verification in Revenue Cycle

To maximize results, blend technology automation with front-line team training.

Technology Essentials:

Integrated eligibility verification tools within your EHR or RCM system.

Real-time payer API connections for instant status updates.

AI-driven risk scoring to flag high-denial-risk cases before scheduling.

For additional insights on how automation transforms this process, check out this resource on insurance eligibility verification automation.

Process & Training Essentials:

Standardized Checklists: Ensure every verification includes coverage dates, network status, COB, service-specific benefits, and authorization needs.

Documentation Discipline: Save PDFs or screenshots of eligibility checks in the patient’s chart for compliance and dispute resolution.

Staff Coaching: Role-play difficult cost conversations and train on payer-specific quirks.

Bilingual Team Members: Improves accuracy and patient experience in diverse populations.

For organizations looking to strengthen these strategies further, automating patient eligibility checks can significantly cut claim denials and streamline the revenue cycle.

Bottom Line

Eligibility verification in the revenue cycle is not just an administrative step — it’s a front-line defense against lost revenue. By detecting coverage gaps before they turn into denials, providers can shorten payment cycles, reduce rework costs, and improve patient trust.

The formula is clear: Automate where you can, standardize where you can’t, and train your team to handle both.

When your front desk and billing staff work together on a robust eligibility verification process, your revenue cycle runs smoother, your denials decrease, and your financial outlook becomes far more predictable.