CDI and Revenue Integrity: Two Sides of the Same Coin

In today’s healthcare landscape—where margins are thin, regulatory demands are high, and value-based care models are expanding—CDI and Revenue Integrity are not just operational necessities, they are strategic pillars of organizational success. This article explores how these functions act as dual engines, powering both clinical accuracy and financial stability.

Table of Contents

The Financial Engine of Healthcare

In healthcare, accuracy is both a patient care imperative and a business necessity. Clinical Documentation Integrity (CDI) and Revenue Integrity may seem like separate entities, but together they form the foundation of a healthy revenue cycle. When aligned, they deliver higher revenue capture, fewer denials, stronger compliance, and better patient outcomes. When siloed, they create costly inefficiencies.

“Healthcare organizations that integrate CDI with Revenue Integrity can see denial rates drop by 30% or more in the first year, simply by improving documentation and charge accuracy.”

The CDI Side: Accuracy Starts at the Bedside

CDI is a disciplined, collaborative process that ensures a patient’s medical record is a complete, precise, and timely reflection of their entire clinical journey—from admission to discharge. CDI specialists work side-by-side with physicians, nurses, and ancillary staff to clarify diagnoses, document clinical indicators, and ensure that comorbidities, complications, and the severity of illness are all accurately captured. This includes reviewing physician notes, lab results, imaging reports, and consult documentation to eliminate ambiguities and close information gaps.

of hospital executives report that documentation gaps have directly caused lost revenue.

of claims are denied on first submission, most often due to documentation and coding errors.

Why CDI Matters:

Accurate Coding: High-quality documentation serves as the blueprint for accurate ICD-10 and CPT coding. Without specificity, coders may assign less precise codes, which can result in underpayment, overpayment, or potential fraud exposure.

Reflecting Patient Acuity: Thorough CDI ensures the patient’s full clinical complexity is documented, which supports precise risk adjustment, impacts DRG assignment, and influences public quality reporting and reimbursement under value-based care models.

Compliance & Audit Readiness: Robust documentation establishes medical necessity and creates a defensible record that stands up to payer scrutiny, RAC audits, and regulatory reviews, reducing the risk of repayment demands or penalties.

“Think of CDI as the quality control at the starting line—if the data isn’t right from the beginning, every subsequent step in the revenue cycle will be flawed.”

The Revenue Integrity Side: Protecting the Financial Pipeline

Revenue Integrity is the safeguard that ensures the meticulous, clinically accurate documentation from CDI is transformed into claims that are both complete and fully compliant with payer and regulatory requirements. It is a proactive, end-to-end oversight function that bridges clinical operations with the financial side of healthcare delivery, protecting every dollar earned.

of net patient revenue lost annually due to charge capture issues—about $15M for a $500M health system.

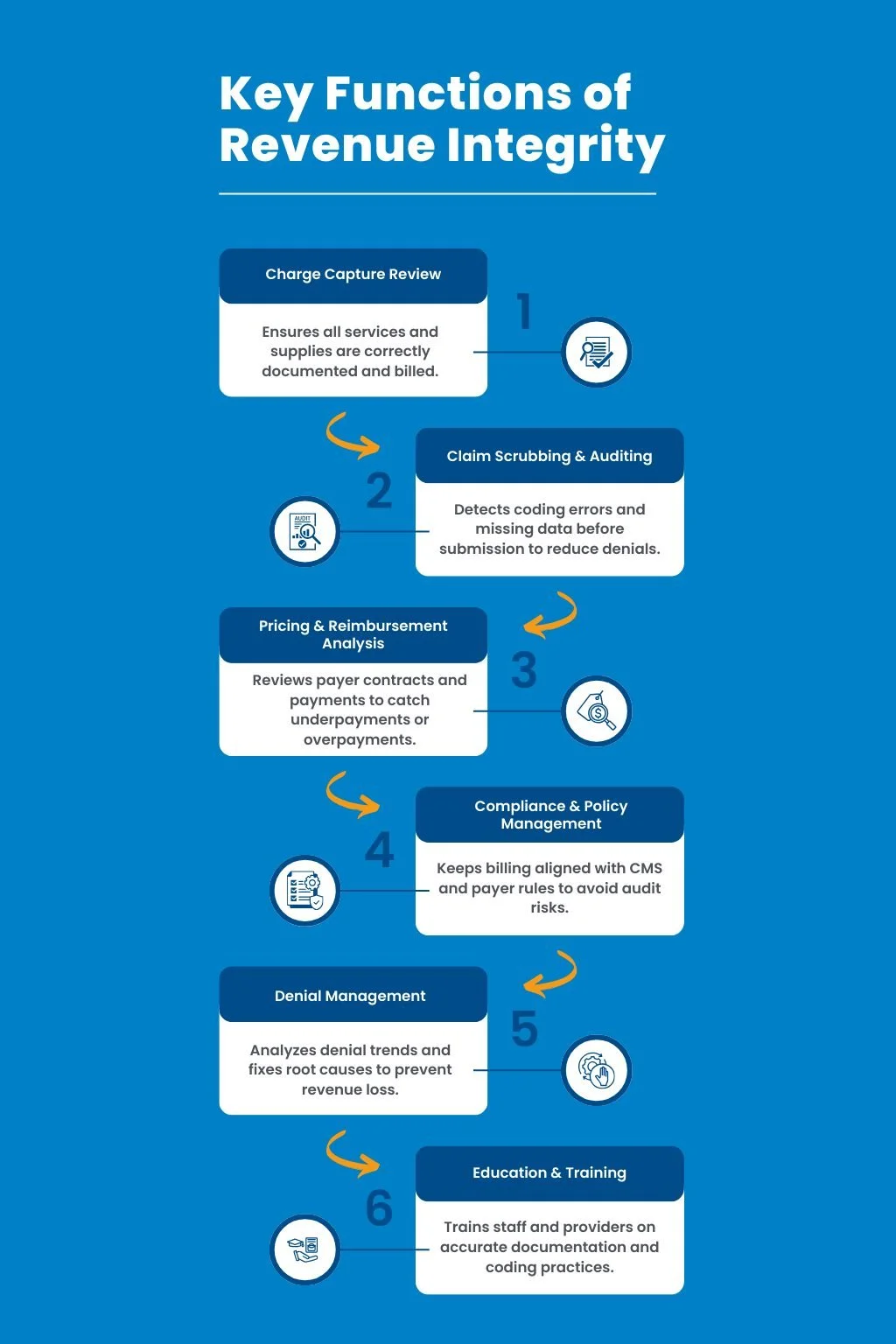

Key Functions:

Charge Capture Review: Systematically verifies that all services, procedures, and supplies provided to the patient are correctly recorded and billed. This includes reconciling clinical records with billing systems to prevent revenue leakage from unbilled or miscoded items.

Claim Scrubbing & Auditing: Uses automated and manual reviews to detect inconsistencies, coding errors, or missing elements in claims before they are submitted to payers. This step significantly reduces first-pass denials and accelerates reimbursement timelines.

Pricing & Reimbursement Analysis: Continuously evaluates payer contracts, fee schedules, and reimbursement patterns to ensure that services are priced correctly and paid at the negotiated rates. Identifies trends in underpayments or overpayments for timely resolution.

Compliance & Policy Management: Monitors changes in payer policies, CMS regulations, and industry guidelines to ensure all billing and coding practices remain compliant. Coordinates with compliance officers to address potential risk areas before they trigger audits.

By executing these functions in alignment with CDI, Revenue Integrity acts as both a gatekeeper and a quality control specialist for the organization’s revenue stream. To see how this aligns with building a comprehensive CDI program that supports physicians, coders, and compliance, explore this detailed resource.

“Revenue Integrity is the safety net that catches errors before they cost the organization money—or worse, its reputation.”

The Synergy: One Unified Goal – CDI and Revenue Integrity

When CDI and Revenue Integrity operate as a cohesive unit, they create a closed feedback loop that continuously strengthens both clinical documentation and financial outcomes.

How CDI strengthens Revenue Integrity: Complete, specific, and timely documentation eliminates ambiguity, making it easier for Revenue Integrity teams to validate charges, ensure accurate code assignment, and process clean claims with minimal rework.

How Revenue Integrity supports CDI: Through detailed claims analysis and denial pattern tracking, Revenue Integrity teams can identify recurring documentation deficiencies, share targeted feedback with CDI specialists, and help guide provider education to prevent future errors.

Case Example: A large Midwest hospital system integrated both teams into a shared dashboard and cross-functional workflow:

Documentation-related denials dropped 28%, saving hundreds of staff hours previously spent on appeals.

Average days in A/R improved by 12%, accelerating cash flow and reducing outstanding receivables.

Improved RAF score accuracy contributed to a $3.5M increase in value-based payments.

Cross-department collaboration reduced duplicate queries to providers by 40%, improving physician satisfaction.

This synergy not only protects revenue but also fosters a culture of shared accountability between clinical and financial teams, ensuring that both patient care and organizational sustainability are supported. To learn more about how CDI drives revenue cycle success, check out this guide.

The Future of Financial Health

As payment models evolve toward value-based care, bundled payments, and risk-based contracts, integration between CDI and Revenue Integrity moves from being beneficial to being mission-critical. Without seamless collaboration, organizations risk leaving substantial revenue uncollected, misrepresenting patient acuity, or failing audits.

Together, CDI and Revenue Integrity:

Reflect true quality of care by ensuring that clinical records accurately depict the patient journey, supporting quality reporting and performance metrics.

Justify every billed dollar through a clear, compliant link between documented care and submitted claims, reducing disputes and payer pushbacks.

Reduce compliance risk by proactively aligning both documentation and billing with evolving CMS guidelines, payer requirements, and audit expectations.

Strengthen payer negotiations by providing robust, defensible data on case mix, resource utilization, and documented complexity—equipping leaders with leverage in contract discussions.

This future-focused approach positions organizations to thrive in a healthcare environment where financial health depends on precision, transparency, and demonstrable value. For a comprehensive overview of how CDI supports these outcomes, see clinical documentation improvement in healthcare.

“The organizations that will thrive in the next decade are those that see CDI and Revenue Integrity not as separate departments, but as one continuous process from bedside to balance sheet.”

The MBW RCM Advantage

At MBW RCM, we build Clinical Documentation Integrity–Revenue Integrity programs that are tailored to the unique workflows, specialties, and strategic goals of each client. Our programs combine clinical expertise, coding precision, and advanced analytics to create sustainable revenue cycle improvements.

Improve documentation at the point of care through real-time provider engagement, specialty-specific templates, and concurrent chart reviews that close gaps before discharge.

Ensure compliance with AHIMA and ACDIS best practices by integrating standardized, non-leading query protocols, ongoing staff training, and regular compliance audits.

Maximize charge capture and reimbursement accuracy with technology-enabled reconciliation processes, automated charge tracking, and contract management tools.

Reduce denials with proactive reviews that identify high-risk claims, address documentation weaknesses before submission, and implement root cause corrections.

Provide leadership with transparent ROI metrics via dashboards and reports that track CMI shifts, denial trends, RAF score accuracy, and recovered revenue, supporting informed decision-making at the executive level.

Conclusion

CDI and Revenue Integrity are inseparable partners. Aligning them ensures the patient’s story is fully told and the organization is reimbursed fairly and compliantly.**

Contact MBW RCM to learn how we can help you integrate CDI and Revenue Integrity for better compliance, higher revenue, and long-term sustainability.