Path to Payment: A Step-by-Step Guide to the Claims Submission Process

Have you ever wondered what happens to a patient’s bill from the moment they walk in the door to the day the payment arrives? The claims submission process is the backbone of healthcare revenue cycle management (RCM). Yet, for new staff—or organizations without a standardized workflow—it can feel like a confusing maze, full of opportunities for mistakes that lead to denials, payment delays, or lost revenue.

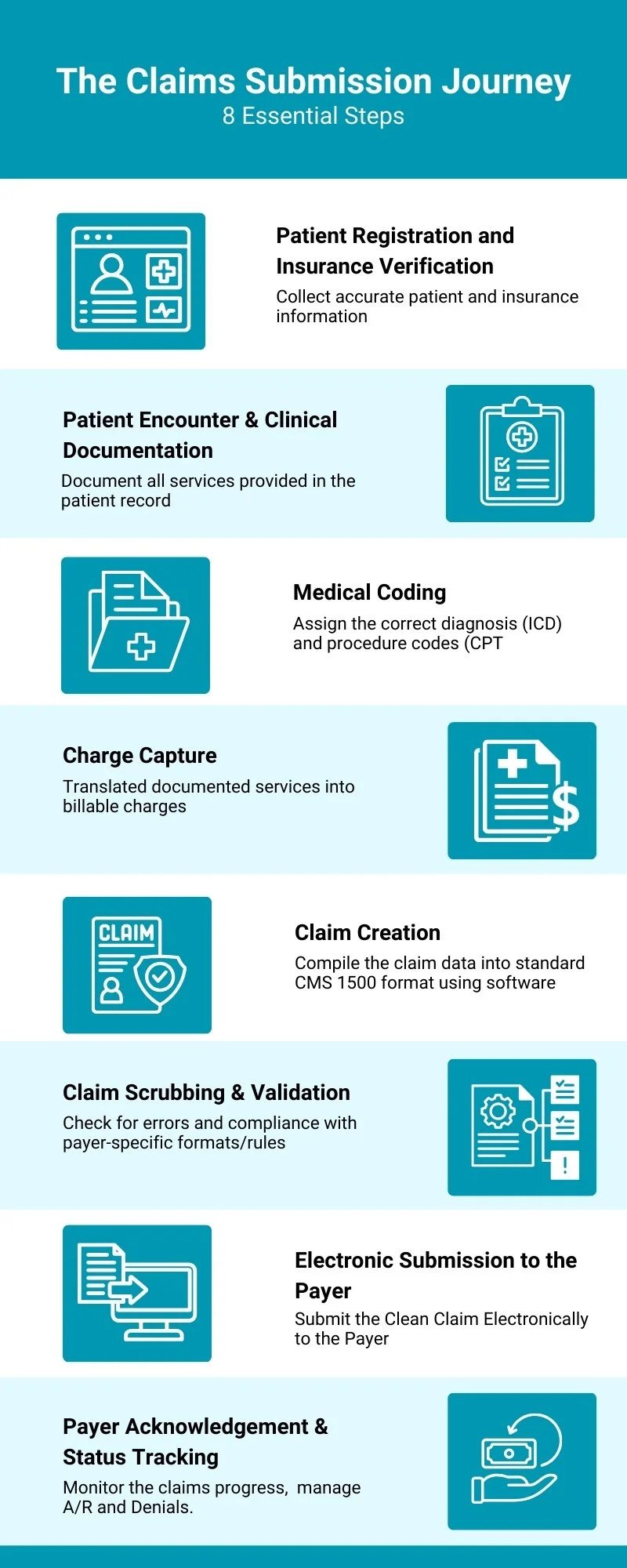

This guide serves as your comprehensive roadmap, breaking the journey into eight essential steps. By mastering each checkpoint, you can protect revenue, reduce rework, and ensure smoother cash flow.

Table of Contents

Step 1: Patient Registration & Insurance Verification

This is the first and most critical step—your foundation for a clean claim. Accurate patient demographics (name, DOB, address) and insurance details must be captured. Even a minor error like a misspelled name or outdated insurance ID can trigger an instant rejection.

Why it matters: According to Change Healthcare, 24% of denials stem from registration or eligibility errors.

Best practices:

Verify eligibility in real-time at scheduling and check-in.

Use clearinghouse or payer portals to confirm policy status, benefits, and copay requirements.

Standardize staff workflows with a registration checklist.

Step 2: The Patient Encounter & Clinical Documentation

Every service rendered must be thoroughly documented in the patient’s chart. Documentation is both a legal record and the financial basis for billing.

Why it matters: If it’s not documented, it cannot be billed. Incomplete documentation often leads to coding errors, downcoding, or payer audits.

Best practices:

Train providers on compliant, detailed note-taking.

Implement EHR templates to prompt complete capture of diagnoses, history, procedures, and time-based services.

Regular audits to check documentation completeness and accuracy.

Step 3: Charge Capture

At this step, clinical services become billable charges. Providers or staff must ensure every eligible service is translated into a charge, either through an electronic superbill or within the EHR.

Why it matters: Missed or inaccurate charge capture is essentially lost revenue. Studies show 3–5% of hospital revenue is lost annually due to poor charge capture.

Best practices:

Use automated charge capture systems to reduce reliance on manual processes.

Reconcile charges daily—compare documented services against charges submitted.

Educate providers about commonly missed services (e.g., prolonged visits, add-on procedures).

Step 4: Medical Coding

Certified medical coders translate clinical documentation into ICD-10, CPT, and HCPCS codes. Correct coding ensures services are billed accurately, medical necessity is clear, and compliance with payer rules is met.

Why it matters: Coding errors are one of the top causes of denials. CMS estimates that up to 42% of claim denials stem from coding issues.

Best practices:

Conduct ongoing coding audits and feedback sessions.

Stay current with annual CPT/ICD code updates.

Leverage computer-assisted coding (CAC) tools to enhance speed and accuracy.

If you are interested to read more claim submission in specialty specific insights, please have a look at this blog on ‘‘OB/GYN CPT Codes in Claim Submission for Obstetrics and Gynecology Practices’’.

Step 5: Claim Creation

All claim elements—patient demographics, provider details, diagnoses, charges, and services—are compiled into a CMS-1500 (professional claims) or UB-04 (institutional claims) form, then converted into an electronic file format (ANSI 837).

Why it matters: A complete and properly structured claim ensures smooth payer processing. Missing NPI, incorrect rendering provider, or mismatched data fields can stall payment.

Best practices:

Automate claim creation through integration with your EHR.

Establish claim templates for repeat services to minimize manual entry.

Validate provider enrollment and NPI information regularly.

Step 6: Claim Scrubbing & Validation

Before claims reach payers, they’re scrubbed by a clearinghouse—checked against thousands of payer rules, edits, and compliance requirements.

Why it matters: Scrubbing can raise first-pass acceptance rates to 95%+, while manual-only workflows average around 70–80%. Every rejected claim requires staff time and delays cash flow.

Best practices:

Customize scrubber rules for high-volume payers.

Track scrubber rejection reports weekly to fix recurring issues.

Build a denial prevention playbook from scrubber insights.

Step 7: Electronic Submission to the Payer

Once validated, claims are electronically transmitted to the payer. This step ensures timely filing and creates a digital submission record.

Why it matters: Electronic claims are processed 7–14 days faster than paper. Payers also provide electronic submission confirmation, protecting providers from “lost claim” disputes.

Best practices:

Submit claims daily (not in weekly batches) to shorten turnaround times.

Monitor payer-specific filing deadlines—some are as short as 30 days.

Automate submission scheduling for consistency.

Step 8: Payer Acknowledgment & Status Tracking

The payer sends an acknowledgment that the claim was received, then processes it through adjudication. From here, you must track claim status until payment or denial.

Why it matters: Without tracking, claims can sit unnoticed until timely filing deadlines expire. Industry data shows providers who actively monitor claim status experience 20–30% fewer denials.

Best practices:

Use clearinghouse dashboards for real-time tracking.

Flag claims that age beyond 20 days without payer action.

Create a denial management workflow for prompt corrections and appeals.

For more compliance guidelines, Check this comprehensive claims submission resource.

Conclusion: Standardize and Succeed

A breakdown at any step can derail the payment journey. Standardizing and monitoring each checkpoint creates a repeatable, efficient workflow that minimizes errors and accelerates revenue.

By understanding and mastering these eight steps, your team transforms claim submission from a chaotic maze into a streamlined pathway, ensuring consistent cash flow and healthier financial performance.

To get an expert review of your current claims workflow and help in standardizing your path to payment, contact MBW RCM today.