Preparing for an Audit: A Proactive Guide for ABA Practices

Audits can feel overwhelming for ABA practices, but they don’t have to be. Whether triggered by a payer, regulator, or internal compliance team, an audit is designed to confirm that claims, documentation, and services are compliant with payer rules. By preparing in advance, ABA providers can reduce the risk of recoupments, protect revenue, and demonstrate the value of their therapy services.

Table of Contents

Why ABA Practices Are High Targets for Billing Audits

ABA billing is unique compared to other healthcare services. Because autism therapy often requires 20–40 hours of care per week, insurers scrutinize claims far more closely than routine outpatient services. A recent review showed that 35–40% of ABA providers experience documentation or billing audits within their first five years.

Audits are commonly triggered by high therapy hours per client, repeated denials, inconsistent documentation, or expired prior authorizations. According to the Centers for Medicare & Medicaid Services (CMS) Program Integrity Manual, even small inconsistencies—like missing start/end times in session notes—can justify an audit.

Building a Culture of Compliance in ABA Practices

Creating an audit-ready culture means more than reacting to payer requests. It requires embedding compliance into everyday operations. Practices can:

Educate every staff member (BCBAs, RBTs, and admin staff) on documentation requirements.

Use internal audits monthly to review treatment notes, coding, and session logs.

Align treatment plans with payer rules to demonstrate medical necessity.

Resources from the Council of Autism Service Providers (CASP) recommend that ABA organizations establish compliance committees that routinely evaluate documentation standards.

“An audit doesn’t have to be scary if you live like you’re always audit-ready.”

Documentation Standards That Protect ABA Providers

Strong documentation is your best defense in an audit. Auditors usually request initial assessments, treatment plans with measurable goals, daily session notes, and updated progress reports. Missing just one of these elements can lead to recoupments.

Our ABA therapy billing services team has found that incomplete progress notes and unsigned parent/guardian acknowledgments are among the most common reasons payers flag claims. To avoid this, we recommend keeping documentation standardized across all staff and updated at least every six months.

How to Strengthen Prior Authorization Management

Authorization errors remain one of the leading causes of ABA claim denials. When reviewing audit findings, insurers often cite expired authorizations or mismatches between billed hours and approved hours. To prevent this, track every authorization with start and end dates, request renewals 2–4 weeks before expiration, and maintain letters of medical necessity from supervising BCBAs.

In our ABA billing case study, one provider cut denial rates by 28% after implementing stricter authorization tracking procedures.

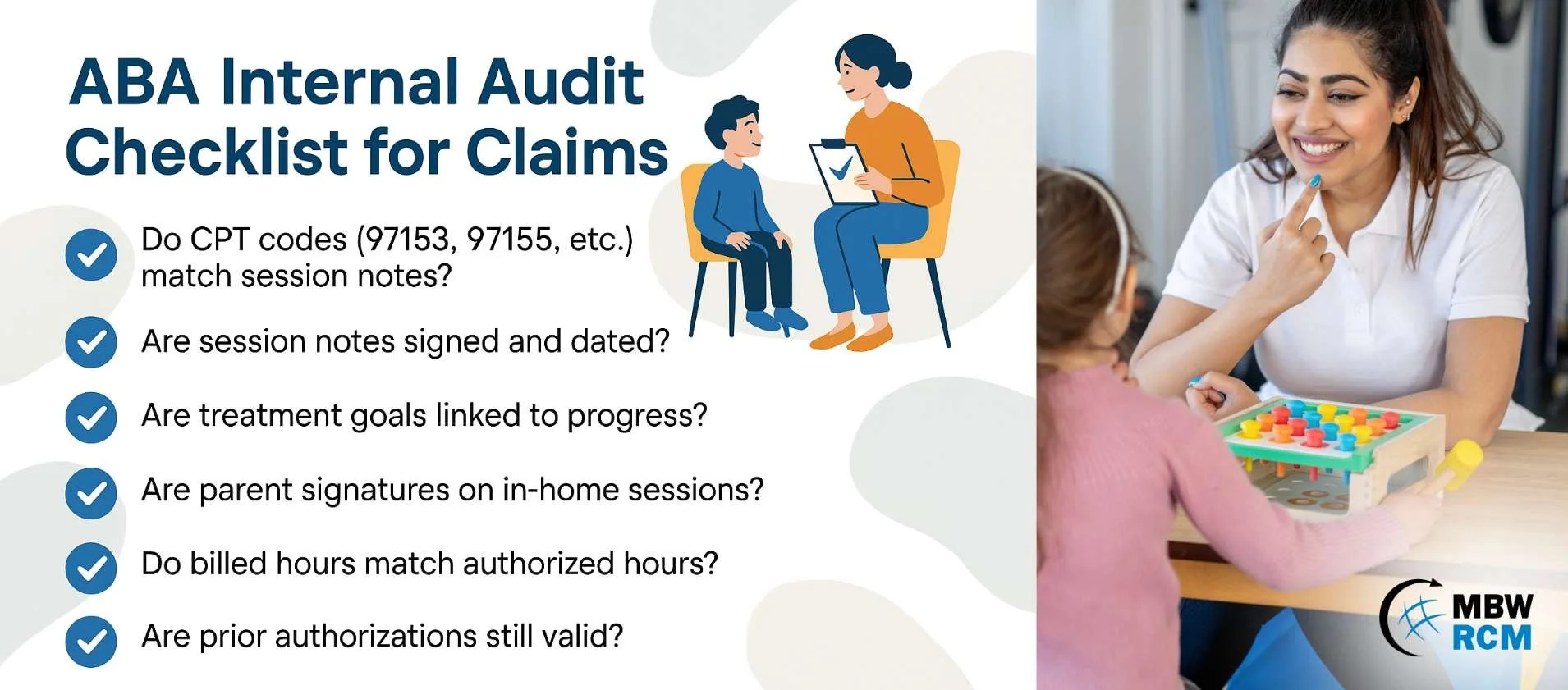

Internal Audit Checklists for ABA Claims

A proactive internal audit checklist can help providers identify risks before payers do. Consider reviewing:

Whether CPT codes (97153, 97155, 97156) match session notes.

If session notes are signed and dated.

Whether treatment goals align with documented progress.

If parent signatures are present on in-home sessions.

Whether billed hours match authorized hours.

Practices that adopt monthly reviews, as recommended by compliance groups, are significantly less likely to face revenue recoupments during an external audit.

Technology Tools That Support ABA Audit Readiness

Modern ABA practices are increasingly turning to billing and EHR systems to reduce manual errors. Software can flag missing data, track authorizations, and generate compliance reports. However, technology works best when paired with trained staff. As highlighted in our guide on ABA therapy and autism services, systems that combine automated alerts with human oversight achieve the best results.

Partnering with ABA Billing Experts for Audit Support

Even with strong processes, many practices choose to outsource billing to specialists for added security. Experienced billing partners conduct documentation audits, manage authorizations, and resubmit denied claims promptly. By acting as an extension of your team, they reduce the likelihood of audits and keep revenue flowing.

Frequently Asked Questions on ABA Audits

Request for Information

Preparing for an ABA audit doesn’t have to be stressful. At MBW RCM, we help ABA providers strengthen documentation, manage authorizations, and build proactive compliance strategies.